property tax assessor las vegas nv

HOW DOES THE ASSESSOR DETERMINE TAXABLE. A tax lien is a claim the government makes on a property when the owner fails to pay the property taxes.

4230 S Decatur Boulevard Las Vegas Nv 89103 Office Building Property For Lease On Loopnet Com Decatur Las Vegas Property Records

Please verify your mailing address is correct prior to requesting a bill.

. Search by Street Name Owner Name Mailing Address and Legal description is. Home is a 4 bed 20 bath property. These values are used to calculate and set levy rates for the various taxing districts cities schools etc in the county and to equitably assign tax responsibilities among taxpayers.

Las Vegas Arrest Records contain an individuals entire criminal history record and are available from Government Offices in Las Vegas Nevada. Taxable value is the value of property as determined by the Assessor using methods prescribed by Nevada Revised Statutes and the Department of Taxation regulations. Several government offices in Henderson and Nevada state maintain Property Records which are a valuable tool for understanding the history of a property finding property.

The new number does not change the propertys legal description only the. If you do not receive your tax bill by August 1st each year please use the automated telephone system to request a copy. Arrest Records are considered public records and as such are available for public request from a number of government agencies including Nevada State County and local law enforcement.

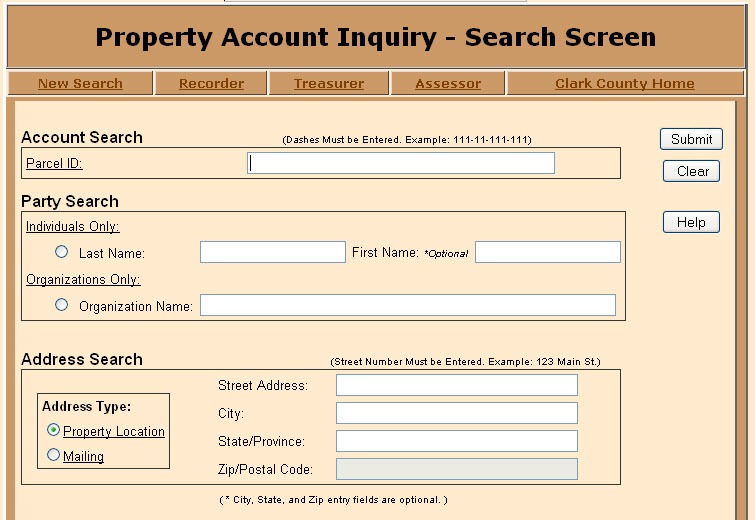

You can use this database to find information about the assessments of any property in Clark County City of North Las Vegas City of Las Vegas Douglas County City of Reno Washoe County City of Henderson Districts City of Mesquite and City of Sparks. Search by Parcel Search by Owner Name. Public Property Records provide information on land homes and commercial properties in Henderson including titles property deeds mortgages property tax assessment records and other documents.

Tax bills requested through the automated system are sent to the mailing address on record. View more property details sales history and Zestimate data on Zillow. Each year the Assessors Office identifies and determines the value of all taxable real and personal property in the county.

The Assessors Parcel Data Systems division assigns these numbers. Generally speaking taxable value of real property is the market value of the land and the current replacement cost of improvements less statutory depreciation. The office is converting the old nine-digit parcel numbers into geographically based eleven-digit parcel numbers.

The Assessors Parcel Number sometimes called APN is used to identify each property in Clark County to be assessed. Welcome to the Assessors Office. Las Vegas Police Departments and Las.

3531 Purdue Way Las Vegas NV 89115-0480 is a single-family home listed for-sale at 240000. Liens are sold at auctions that sometimes involve bidding wars. The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year.

Property Taxes Are Not Uniform And Equal In Nevada The Nevada Independent

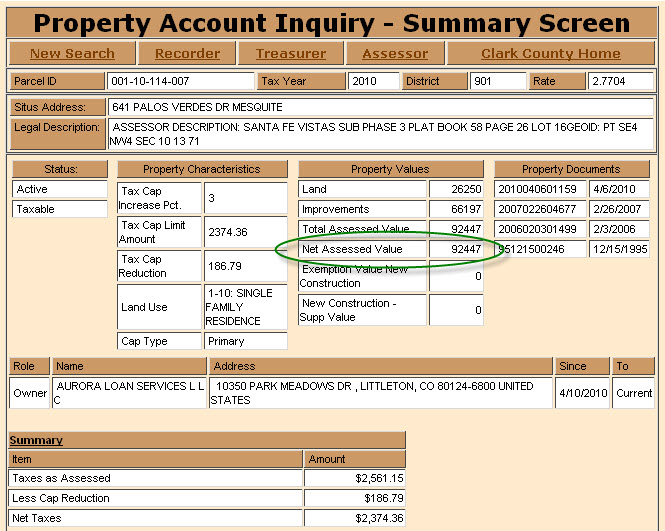

Mesquitegroup Com Nevada Property Tax

Mesquitegroup Com Nevada Property Tax

Clark County Assessor S Office To Mail Out Property Tax Cap Notices Youtube

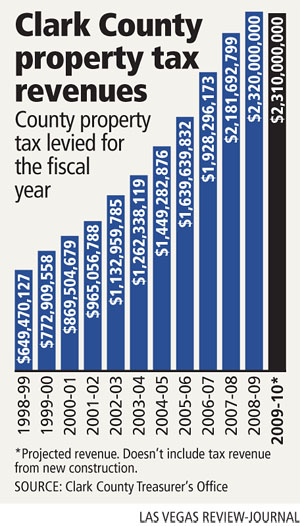

Forecast Gloomy For Property Tax Revenues Las Vegas Review Journal

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

2871 Wheelwright Dr Las Vegas Nv 89121 Duplex Triplex Fourplex Property For Sale On Loopnet Com Triplex Duplex Las Vegas